VCs have developed sophisticated frameworks to evaluate startups, but at the end of the day, they’re still betting on incomplete information. And this is why understanding their evaluation criteria becomes so crucial for founders, especially early stage founders.

But before we dive into the nitty-gritty of the evaluation criteria, let’s get one thing straight: angel and venture capital is fundamentally different from any other form of investment.

Think about it. When a VC looks at your early-stage startup, they’re not seeing financial statements with years of proven performance like a traditional investor might. Instead, they’re trying to predict the future based on fragments: a prototype, some early user feedback, your background, and frankly, their gut feeling about whether you can execute.

However, the criteria outlined here are not a universal rulebook for evaluating every deal. They are insights we’ve gathered through our experience of helping startups raise funds, guidance from our seasoned experts, and learnings gathered from multiple other sources. Venture capital firms may apply their own unique frameworks, and exceptions always exist. Our goal is simply to highlight the most common practices followed across the industry.

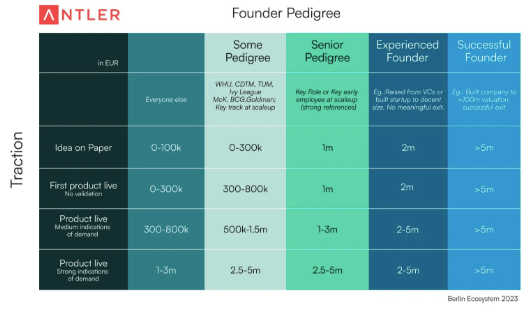

Pedigree of the founders:

The most important factor of a startup getting successful is not the idea or the product itself but it’s execution. And the ability to do that is judged through your pedigree.

Pedigree in terms of your education, past entrepreneurship experience, or having a strong background in consulting or startups.

In India, IIT/IIM (Replace tier 2 IIMs with other Tier 1 B Schools) Graduates are given a strong preference, not because investors are biased, but because cracking IIT/IIM is not an easy task, it shows you are hardworking and smart enough to beat 99% other people. Startups need to beat those odds too.

Your pedigree may also dictate the confidence of an investor while handing you the first cheque, it defines how big would it be.

Market Opportunity: It’s the Nuance, Not the TAM Slide

Fundamental trap: Founders pitch India’s growth and billion dollar TAM slides, but investors’ eyes glaze over unless you’ve cracked how you’ll win. While Market estimates and opportunity sizing are basic hygiene factors of your data-room, Pitching a plan to disrupt a big market without compelling logic is risky.

Investors want proof you understand your market deeply, customer pain points, willingness to pay, competition, and geography-specific nuances that define your real SOM.

In fact, many investors apply their own haircut, often 10–20%, to whatever SOM founders present. It’s their default setting.

To be continued….